selling a car in florida taxes

Browse Our Wide Selection of Easy Do-It-Yourself Legal Forms and Contracts. The plates stay with you the former owner rather than remaining with the car itself.

What Are Dealer Fees In Florida

If you are a Florida resident it is mandatory for you to register your vehicle in the state of Florida within ten days of any of the above occurring even if you bought your car.

. Florida sales tax is due at the rate of two percent on the 20000 sales price of the vehicle. A state tax rate of 6 applies to all car sales in Florida but your total tax rate will vary based on county and local taxes which can be anywhere from 0 to 15. Ad Start and Finish in Minutes.

Florida collects a 6 state sales tax rate on the purchase of all vehicles. After the title is transferred the seller must remove the license plate from. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes.

Theres one scenario in which you must be present at an HSMV office to sell a car. Legal Forms Ready in Minutes. However the total sales tax can be higher depending on the local tax of the area in which the vehicle is purchased in.

Once you file the Notice of Sale Form to the Tax Collectors office according to Florida. Once the lienholder reports to. When you sell a vehicle or vessel you need to protect yourself by filing Form HSMV Notice of Sale.

Collect the buyers home state rate up to Florida 6 No local surtax charged Sale over 500000 The local surtax only applies to the 1st 5000. Create on Any Device. Provide Basic Information To Quickly Receive an Offer.

No discretionary sales surtax is due. Custom Sample Vehicle Bill Of Sale Florida Available on All Devices. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

Thereafter only 6state tax. Before you sell your vehicle make sure to remove the license plates. License Plates and Registrations Buyers must visit a motor vehicle service center to register a vehicle for the first.

The buyer must pay Florida sales tax when purchasing the temporary tag. For the vehicle to be legally sold the lien must first be satisfied. Instead the buyer is.

Ad We Make It Easy To Sell Your Car. In that case youll need to fill out either Form 82994. The seller must indicate the mileage of the vehicle in the appropriate spaces provided on the ownership document.

The vehicle is licensed in the purchasers home state within. In Florida a vehicle cannot be legally sold in a private sale if there is an existing lien. You can then transfer the.

At AllCars You Can Sell or Trade-In Your Car With Us From Anywhere In the USA. Easy Online Legal Documents Customized by You. If the title is electronic rather than physical.

Ad High-Quality Reliable Selling Car In Florida Developed by Lawyers.

Free Alabama Bill Of Sale Template Word Pdf Legaltemplates

How Do Tax Deed Sales In Florida Work Dewitt Law Firm

Sales Taxes In The United States Wikipedia

Florida Vehicle Sales Tax Fees Calculator

Florida Vehicle Sales Tax Fees Calculator

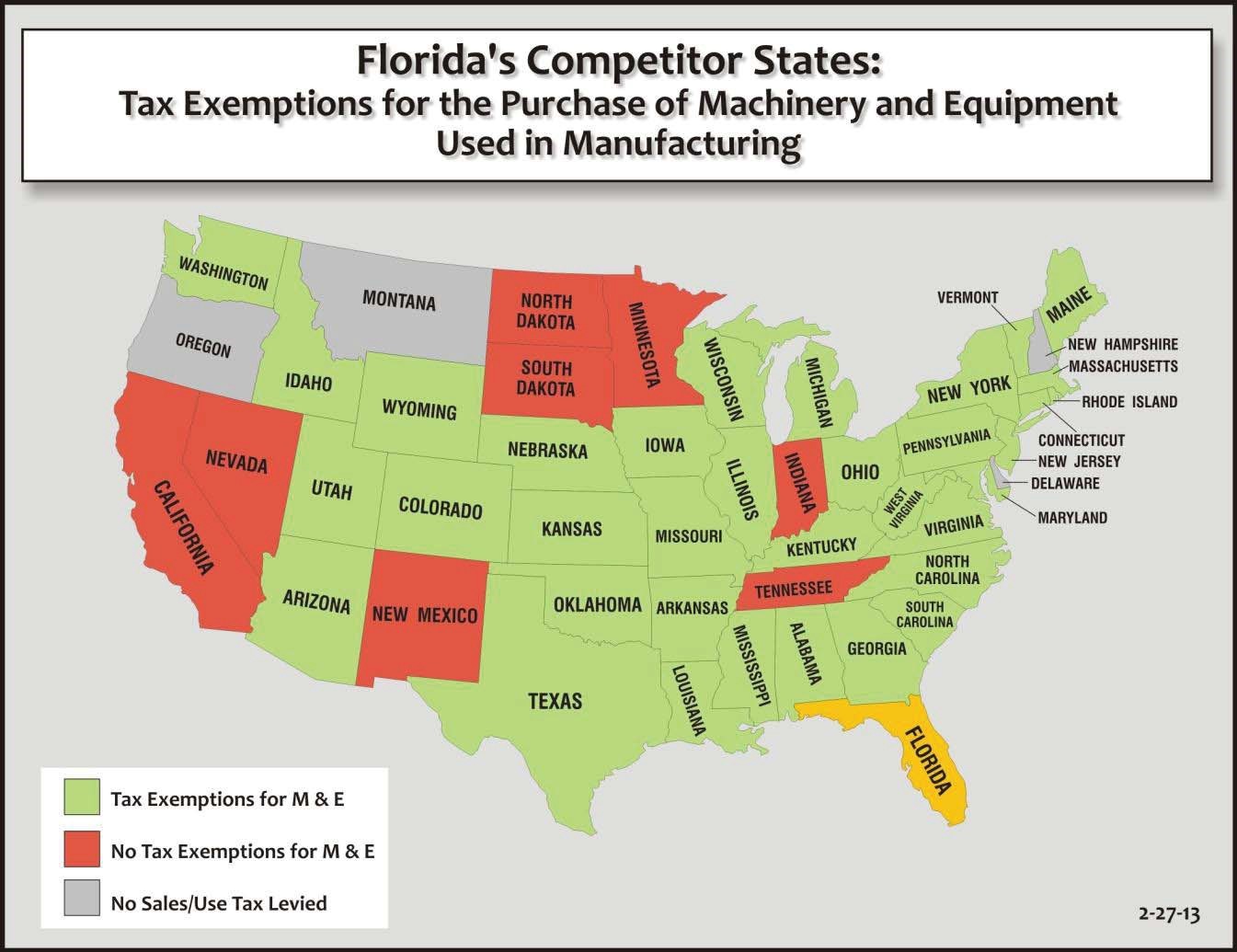

Fl Sales Use Tax Machinery Equipment Exemption Signed Into Law Finally

Florida Vehicle Sales Tax Fees Calculator

Gifting A Car How To Gift A Car To A Family Member Or Sell It For Profit

Buying A Car In Florida From Out Of State

Understanding Taxes When Buying And Selling A Car Cargurus

How Do State And Local Sales Taxes Work Tax Policy Center

How To Report Florida Sales Tax Xendoo

How To Register A Car In Florida

Florida Sales Tax Small Business Guide Truic

What To Know About Taxes When You Sell A Vehicle Carvana Blog

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Florida Sales Tax For Nonresident Car Purchases 2020

4 Steps To Gifting A Car If You Live In Florida Title Transfers Etags Vehicle Registration Title Services Driven By Technology